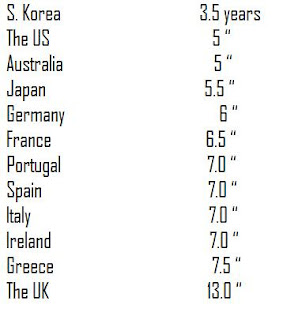

SO why do we care about the average maturity of government debt,well because maturity of the government debt speaks of how much short-term funding pressure a government will feel rolling over its debt and funding operations.So countries with low average maturities are in real trouble.

Now with the yield curve positively sloped[in US],funding at the shortest end of the curve is the least expensive way to fund current spending.But that leave the country being exposed to the vagaries of global interest rates.If the Obama administration's spending policies are not changed,then we are pretty sure that it will be too late to extend one's term structure farther out on the curve,except at onerous rates of interest.The UK may pay more for its funding costs by having the longest termed maturity structure,but its funding is secure where as the US and S.korea may eventually find themselves in a most uncomfortable spot,should things in the international bond market tighten up.

No comments:

Post a Comment